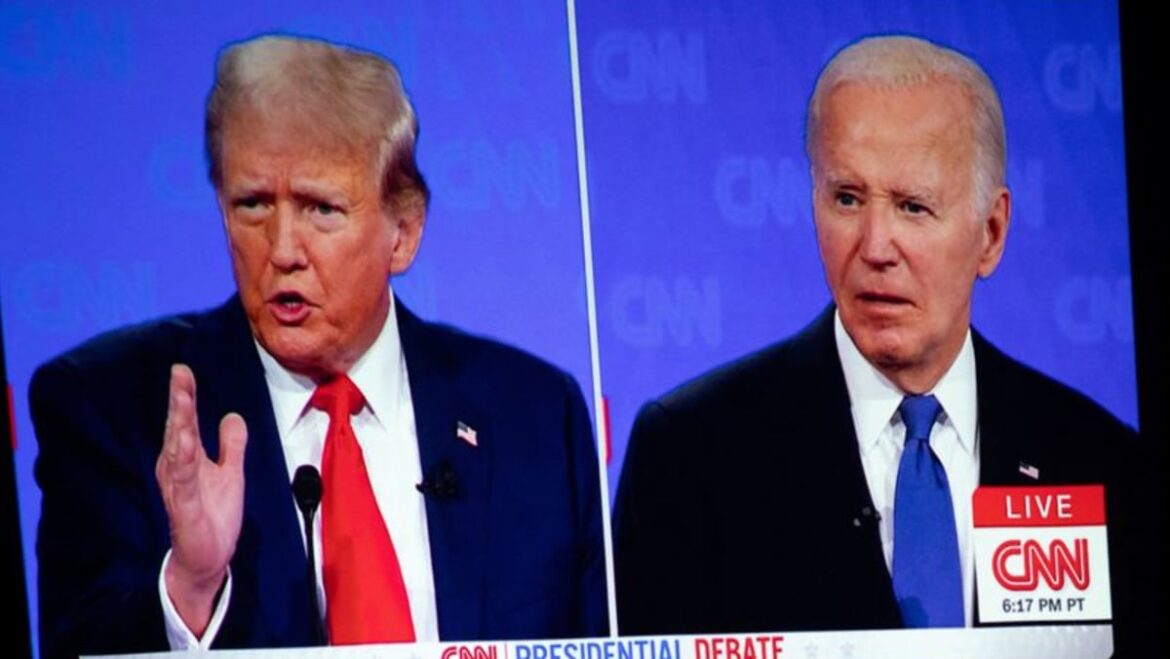

Trump Media shares drop after initial rally on Biden’s shaky debate performance

:Shares of Trump Media & Technology Neighborhood fell in uneven trading on Friday, erasing earlier gains driven by President Joe Biden’s shaky performance against Republican rival Donald Trump at the first 2024 U.S. presidential debate.

TMTG shares were hazardous all year, as the inventory is mostly driven by retail merchants amid Trump’s quest to reach to the White Home. The firm itself loses money and is by some measures one among basically the most overvalued shares amongst U.S. listings, with a designate-to-revenue ratio in the hundreds.

“Fundamentally talking, there would possibly perchance be nothing powerful unhurried the Trump Media & Technology Neighborhood. The moves that we explore are mostly speculative,” said Ipek Ozkardeskaya, senior analyst at Swissquote Bank.

Purchasing and selling volumes surged after Thursday’s debate and shares shot up in the morning as merchants replied to Biden’s performance. Nonetheless the inventory used to be unable to care for on to its gains and used to be closing off by 6 per cent.

The inventory came below stress earlier this month after a jury stumbled on Trump responsible of falsifying paperwork to quilt up a rate to silence a porn indispensable person.

The firm, owner of Trump’s social media platform Reality Social, reported revenue of $770,500 for the March quarter and an adjusted running lack of $12.1 million. It used to be closing valued at $6.7 billion.

TMTG shares rose as powerful as 8 per cent early in the session as Biden’s allies scrambled to receive the fallout from his performance after he struggled to stem a barrage of assaults and unfounded claims from Trump.

Retail merchants were receive merchants of the inventory on Friday, with their buy orders outnumbering sell orders by a 1.6 ratio at 12 p.m. ET, J.P.Morgan data showed.

Trump owned 64.9 per cent of TMTG as of June 10, value about $4.2 billion as of the inventory’s closing close, in keeping with LSEG data.

One after the other, 5 exiguous exchange-traded funds (ETFs) tied to the two U.S. political parties or their platforms were barely engaging after Thursday’s debate.

The greatest of these, the Abnormal Whales Subversive Democratic Purchasing and selling ETF has assets of $94.5 million, and used to be up 0.7 per cent. The Abnormal Whales Subversive Republican Purchasing and selling ETF used to be 0.8 per cent better and has about $24.6 million in assets.

Christian H. Cooper, portfolio manager at Subversive Capital, which launched each funds closing year, said he is seeing flows of KRUZ “modestly above reasonable” on Friday. Rotund flows data for Friday obtained’t be available till Monday.

Source: Reuters