Sam Bankman-Fried sentenced to 25 years for FTX fraud

NEW YORK: Sam Bankman-Fried became sentenced to 25 years in penal advanced by a decide on Thursday (Mar 28) for stealing US$8 billion from customers of the now-bankrupt FTX cryptocurrency alternate he based, the closing step within the light billionaire wunderkind’s dramatic downfall.

US District Think Lewis Kaplan handed down the sentence at a Lengthy island court listening to after rejecting Bankman-Fried’s narrate that FTX customers did no longer really lose money and accusing him of lying at some level of his trial testimony. A jury stumbled on Bankman-Fried, 32, guilty on Nov 2 on seven fraud and conspiracy counts stemming from FTX’s 2022 give method in what prosecutors possess known as one amongst the excellent financial frauds in US history.

Iklan

Main world institutional investors bask in Blackrock, Sequoia and Singapore verbalize investment company Temasek had been caught up within the loss of life of FTX, with the latter writing down its entire investment.

Kaplan said Bankman-Fried had proven no remorse.

“He knew it became rotten,” Kaplan said of Bankman-Fried earlier than handing down the sentence. “He knew it became prison. He regrets that he made a really dangerous bet about the risk of getting caught. Nevertheless he’s no longer going to admit a thing, as is his appropriate.”

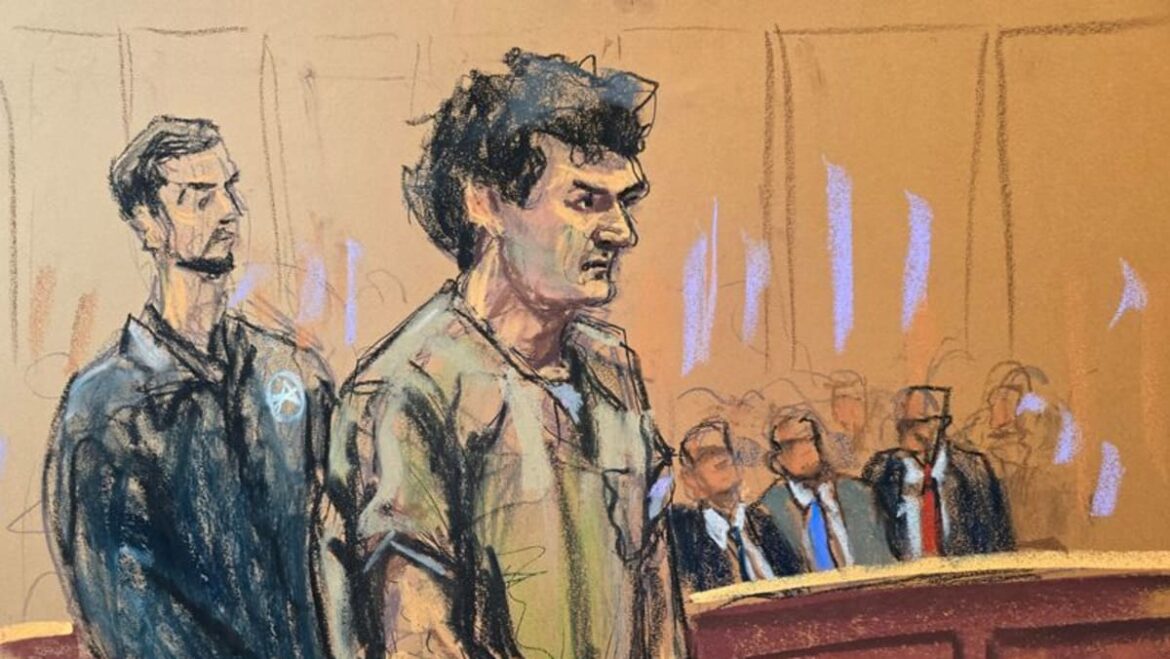

Bankman-Fried stood with his arms clasped earlier than him as Kaplan learn the sentence. He became led out of the court docket by members of the US Marshals Provider when the listening to ended.

Bankman-Fried, carrying a beige quick-sleeve penal advanced t-shirt, acknowledged at some level of 20 minutes of remarks to the decide that FTX customers had suffered and he supplied an apology to his light FTX colleagues.

Iklan

The sentence marked the fruits of Bankman-Fried’s drop from an extremely-prosperous entrepreneur and major political donor to the excellent trophy to this level in a crackdown by US authorities on malfeasance in cryptocurrency markets. Bankman-Fried has vowed to attraction his conviction and sentence.

Kaplan said he had stumbled on that FTX customers misplaced US$8 billion, FTX’s equity investors misplaced US$1.7 billion, and that lenders to the Alameda Compare hedge fund Bankman-Fried based misplaced US$1.3 billion.

“The defendant’s assertion that FTX customers and collectors will likely be paid in beefy is misleading, it’s logically erroneous, it’s speculative,” Kaplan said. “A thief who takes his loot to Las Vegas and successfully bets the stolen money is no longer entitled to a prick sign on the sentence by the utilization of his Las Vegas winnings to pay encourage what he stole.”

The decide also said Bankman-Fried lied at some level of his trial testimony when he said he did no longer know that his hedge fund had spent customer deposits taken from FTX.

Federal prosecutors had sought a penal advanced sentence of 40 to 50 years. Bankman-Fried’s protection licensed expert Marc Mukasey had argued that a sentence of lower than 5-1/4 years would be appropriate.

Iklan

Addressing the decide, Bankman-Fried said, “Customers possess been suffering … I did no longer at all mean to minimise that. I also judge that is one thing that became lacking from what I’ve said over the direction of this activity, and I’m sorry for that.”

Relating to his FTX colleagues, Bankman-Fried instructed the decide, “They keep a couple of themselves into it, and I threw that all away. It haunts me each day.”

Three of his light shut mates testified as prosecution witnesses at trial that he had directed them to use FTX customer funds to drag losses at Alameda Compare.

“MASSIVE IN SCALE”

Nicolas Roos, a prosecutor with the US Lawyer’s place of work in Lengthy island, instructed the decide, “The illegal activity right here is huge in scale. It became pervasive in all aspects of the replace.”

All thru the listening to, Mukasey sought to distance his client from notorious fraudsters bask in Bernie Madoff.

Iklan

“Sam became no longer a ruthless financial serial killer who position out every morning to concern folks,” Mukasey said, describing his client as an “awkward math nerd” who worked powerful to get customers their money encourage after FTX’s give method.

“Sam Bankman-Fried doesn’t develop decisions with malice in his coronary heart,” Mukasey added. “He makes decisions with math in his head.”

Bankman-Fried testified in his enjoy protection that he made errors honest like no longer implementing a risk administration personnel, however denied he intended to defraud any individual or clutch customers’ money.

His parents, Stanford College legislation professors Joseph Bankman and Barbara Fried, attended the sentencing.

A Massachusetts Institute of Expertise graduate, Bankman-Fried rode a negate within the values of bitcoin and other digital belongings to a gain price of US$26 billion, in retaining with Forbes magazine, earlier than he grew to turn out to be 30.

Bankman-Fried turn out to be known for his mop of unkempt curly hair and commitment to a race most continuously known as efficient altruism, which inspires talented childhood to level of interest on getting cash and giving it away to noteworthy causes. He also became one amongst the excellent contributors to Democratic candidates and political causes earlier than the 2022 US midterm elections.

Nevertheless prosecutors possess said the guilty image he cultivated concealed his years-prolonged embezzlement of purchaser funds.

Bankman-Fried has been detained at the Metropolitan Detention Heart in Brooklyn since August 2023, when Kaplan revoked his bail after finding he likely tampered with witnesses no longer lower than twice.

Source: Reuters