MSCI world stock index hits record high, dollar dips after US inflation data

NEW YORK/LONDON : The MSCI world stock index hit a yarn excessive while the U.S. buck index inched decrease on Friday after data showed that U.S. inflation used to be flat in Also can, fueling investor optimism the Federal Reserve would possibly per chance well perchance start cutting pastime rates in September.

U.S. stocks were reasonably bigger after the S&P 500 and Nasdaq hit yarn highs in early Sleek York trading.

The Fed’s most traditional inflation measure, the non-public consumption expenditures (PCE) index, showed that annual increase in prices used to be 2.6 per cent in Also can, as economists had expected, down from 2.7 per cent in April.

“Even as you evaluate what we obtained on the present time with expectations, it is amazingly great in-line and so the Fed will doubtless bear ample consolation by the level of the September 18th meeting to reduce rates for the foremost time,” acknowledged Art Hogan, chief market strategists at B Riley Wealth in Sleek York.

The prospect of a rate reduce in September inched as a lot as 68 per cent from 61 per cent before the solutions, as per LSEG FedWatch data.

Traders were aloof digesting the U.S. presidential debate from late Thursday between Democratic President Joe Biden and Republican rival Donald Trump before the November election.

Trump Media & Technology Neighborhood shares rose sharply early nevertheless were closing down about 3 per cent.

The Dow Jones Industrial Practical rose 96.18 facets, or 0.26 per cent, to 39,264.37, the S&P 500 won 14.49 facets, or 0.26 per cent, to 5,497.36 and the Nasdaq Composite won 39.87 facets, or 0.23 per cent, to 17,899.56.

MSCI’s gauge of stocks across the globe used to be up 1.60 facets, or 0.20 per cent, at 805.35 after hitting a yarn at 808.37 earlier. The STOXX 600 index fell 0.27 per cent.

The buck index, which measures the buck towards a basket of currencies, used to be down a exiguous bit at 105.85.

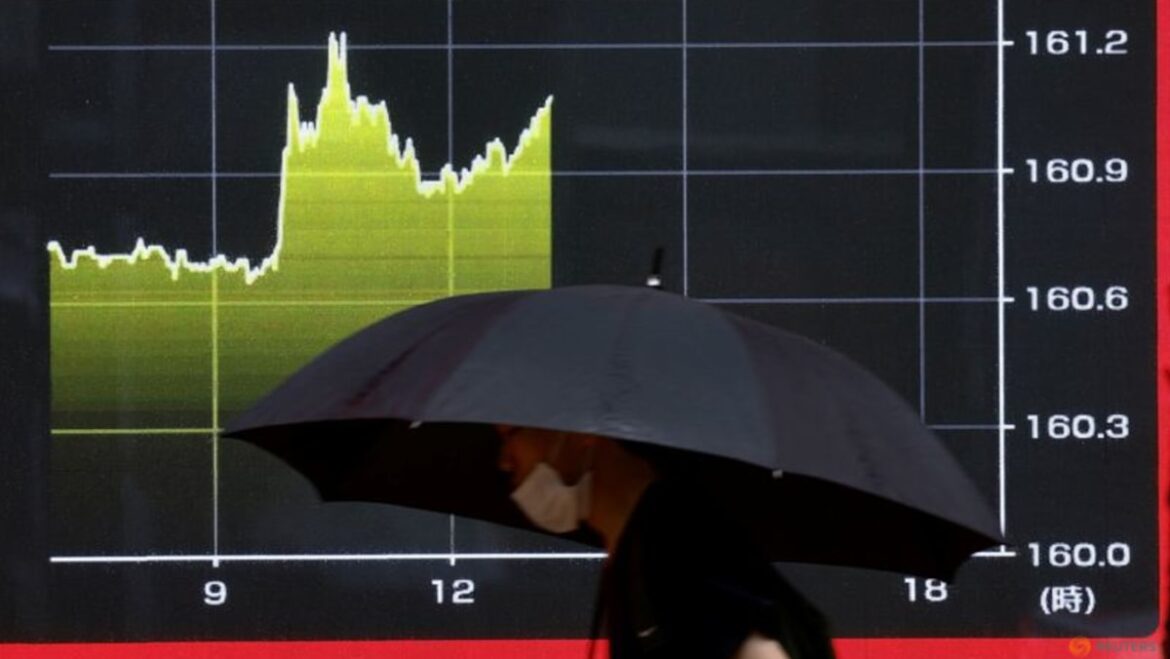

The U.S. buck fleet fell towards the Japanese yen after the PCE data. Against the yen, the buck closing used to be up 0.09 per cent at 160.88.

The yen’s toddle to a 38-three hundred and sixty five days low has fueled expectations of intervention by the Japanese authorities to stem the forex’s weak point.

The euro used to be up 0.06 per cent at $1.0708.

Worries regarding the final end result of the two-stage French parliamentary elections that open on Sunday pushed the risk top rate on French authorities bonds over German bonds to its widest for the reason that euro zone debt disaster in 2012.

In Treasuries, the yield on benchmark U.S. 10-three hundred and sixty five days notes rose 4.3 basis facets to 4.331 per cent, from 4.288 per cent late on Thursday.

U.S. uncouth misplaced 0.48 per cent to $81.35 a barrel while Brent used to be flat at $86.39 per barrel.

Source: Reuters