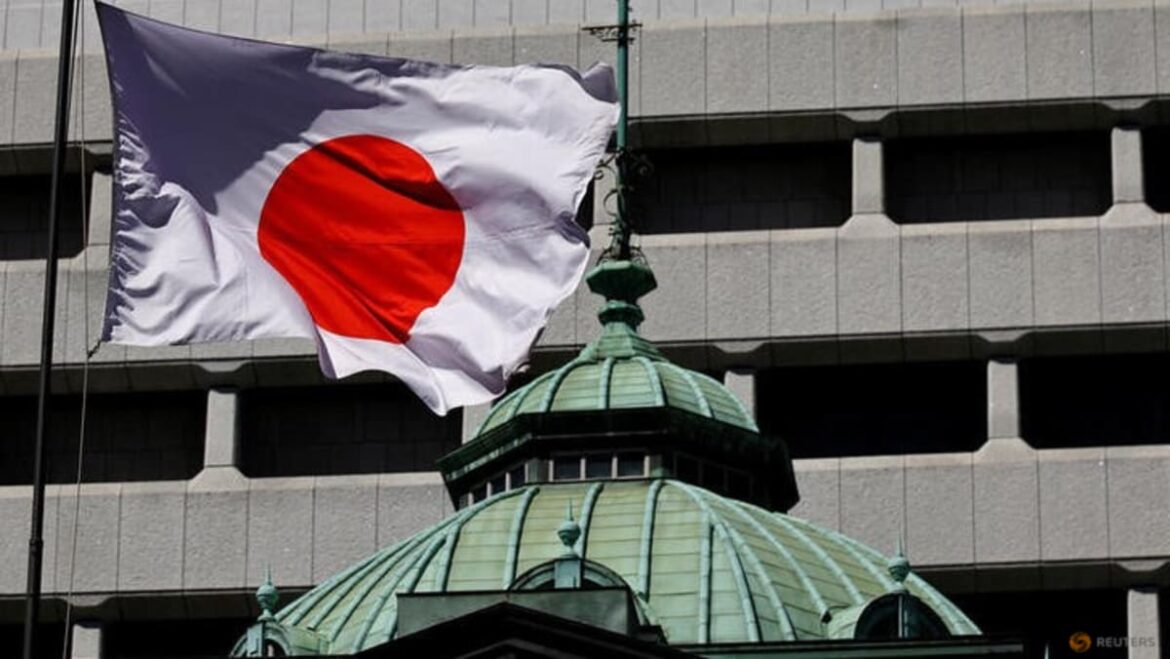

Japan manufacturers want BOJ to keep yen stable, survey shows

TOKYO :Japan’s wide manufacturers noticed alternate price balance because the greatest part they wished out of the central monetary institution’s monetary policy, a Bank of Japan witness showed on Monday.

Roughly 70 per cent of companies polled said they experienced drawbacks from the BOJ’s 25-year-prolonged monetary easing measures alongside with a aged yen that pushed up import costs, the witness showed.

Iklan

About 90 per cent of the overall also noticed advantages from the BOJ’s prolonged easing equivalent to low borrowing costs, the ballotshowed.

The witness, performed on roughly 2,500 companies nationwide, highlights the importance Jap companies plan on yen strikes in assessing the affect of monetary policy.

Many companies surveyed also said they had been no longer in a predicament to rent ample workers in the occasion that they kept wage growth low, and noticed an financial system the place wages and inflation rose in tandem as extra beneficial than one the place wages and costs barely moved.

“Japan is on the cusp of seeing mountainous changes in corporate behaviour,” the BOJ said in the witness performed as segment of a prolonged-term overview of the professionals and cons of its previous monetary easing steps.

About 90 per cent of companies said they had been extra entertaining to hike wages largely to contend with labour shortages, while over 80 per cent said they found it more uncomplicated than sooner than to hike costs, the witness showed.

Iklan

The findings underscore the BOJ’s ponder that rising wages and costs will withhold inflation sustainably round its 2 per cent aim, and enable it to rob hobby charges from most current shut to-zero stages.

The BOJ ended eight years of adverse hobby charges and other remnants of its radical monetary stimulus in March, making a historical shift away from a protracted time of extremely-loose policy.

However the decision did now not reverse the yen’s declines that devour peril consumption by pushing up imported items costs, as markets centered on the indifferent-wide hobby price divergence between Japan and the US.

The prolonged-term overview became launched by BOJ Governor Kazuo Ueda in April closing year, and seems to be into the advantages and drawbacks of the unconventional easing tools the central monetary institution aged for the length of its 25-year fight with deflation.

While the BOJ has said the overview obtained’t devour a direct affect on future monetary policy, analysts affirm the discussions may perchance well perchance perchance provide clues on how rapidly the central monetary institution would elevate charges once more and reduce its wide bond purchases.

Iklan

Monday’s witness, which became segment of the overview, polled companies on how they noticed their enterprise activities tormented by the central monetary institution’s monetary easing measures for the explanation that mid-Nineties.

The BOJ will also assign on Tuesday a 2d workshop the place its officials and lecturers focus on the affect of previous monetary easing steps on the financial system and costs.

Source: Reuters