Hedge funds make massive retreat from short yen positions, UBS says

HONG KONG : World hedge funds made an enormous retreat from their bearish bets on the Eastern yen at some stage within the currency’s solid upward push in opposition to the U.S. greenback over the final two weeks, a UBS gift to potentialities seen by Reuters on Tuesday said.

Hedge funds coated with regards to all of the short yen positions built up over the final year, because the yen rallied by roughly 5 per cent in opposition to the U.S. greenback since July 10, UBS said in a present on Monday, citing its interior international exchange circulation info without disclosing the numbers.

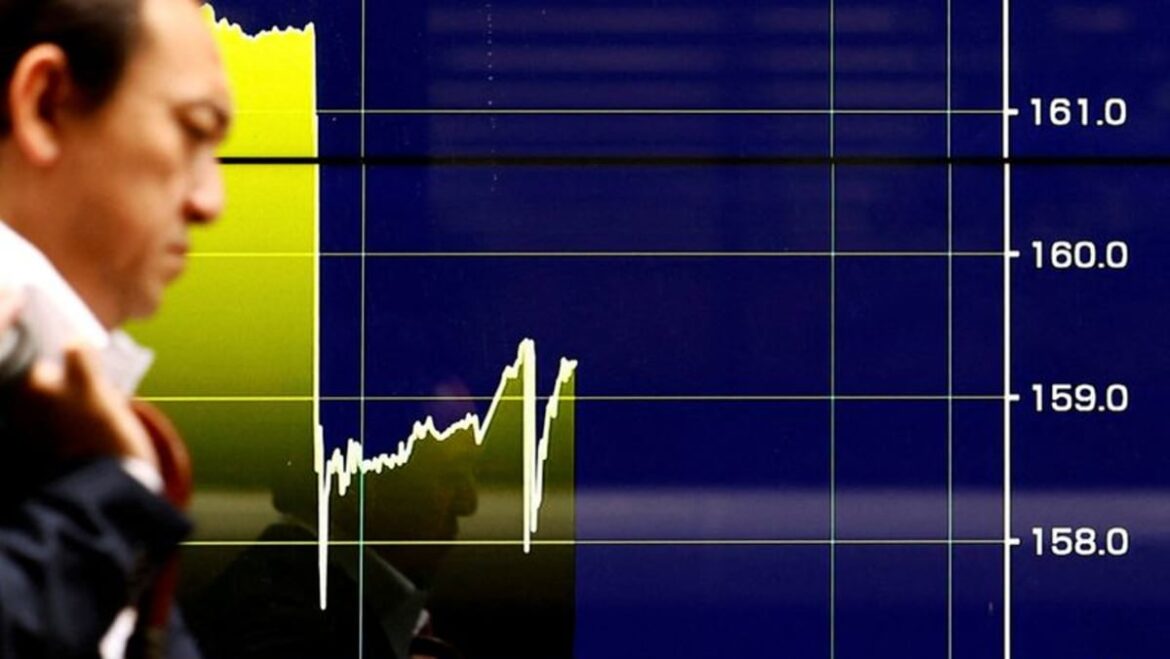

A with regards to $40 billion suspected intervention by Eastern authorities has driven the yen to roughly 153 per greenback from around 162 per greenback in mid-July.

“I tell the Financial institution of Japan’s aim is to convince investors no longer to bet in opposition to them and to push the market to deleverage the elevate alternate,” Zhiwei Zhang, president at hedge fund Pinpoint Asset Administration, said.

The reversal within the yen’s pattern additionally disrupted neatly-liked elevate trades whereby an investor borrows in a currency with low passion charges and invests within the next-yielding currency.

The yen turned into the most neatly-liked funding currency as Japan has the bottom passion price among the G10 currencies. Analysts said investors have to watch choices now the yen has become too unstable.

Japan’s central bank started a two-day coverage assembly that may kind on Wednesday. Market merchants non-public shown warning this week as they no longer sleep for upcoming passion price choices and puny print of its realizing to gradually retreat from its broad purchases of authorities bonds.

No longer every person is ecstatic by the BOJ’s intervention, nonetheless, and views on the yen’s future direction are rising divergent.

No longer just like the hedge funds’ pull-abet, the exact money community, or outdated prolonged-only asset managers, extinct “the most recent yen rally as an different to preserve promoting the currency,” UBS said within the an identical gift.

Source: Reuters