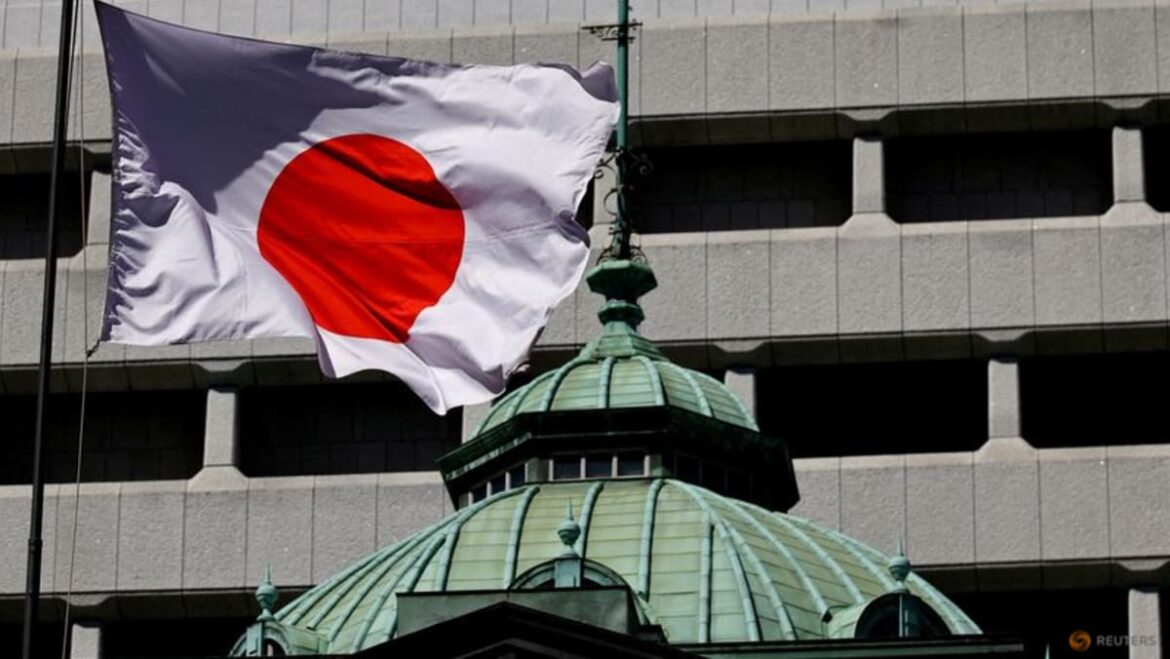

BOJ to weigh rate hike next week, detail plan to halve bond buying, sources say

TOKYO : The Monetary institution of Japan is at risk of debate whether or now not to understand pastime charges when it meets next week and unveil a concept to roughly halve bond purchases in coming years, sources said, signalling its unravel to gradually unwind its big financial stimulus.

The price resolution will depend on how long the board members opt to look ahead to readability on whether or now not consumption will salvage wisely and sustain inflation stably around the bank’s 2 per cent target, said four other folks accustomed to the BOJ’s pondering.

Over three-quarters of economists polled by Reuters keep a matter to the central bank to face pat this month and presumably next circulate in September or October, but sources urged the final result of the July 30-31 assembly turn out to be considerably much less obvious.

“The resolution will be a discontinuance name and a onerous one to fabricate,” given uncertainty over the consumption outlook, no doubt one of many sources said. “It is in fact a judgment name, in phrases of whether or now not to act now or later this one year,” one other person said.

Whereas the 9-member board broadly is of the same opinion on the necessity for a advance-term price hike, there isn’t at all times a consensus on whether or now not it goes to also peaceful happen next week or later in the one year, they said.

Core inflation hit 2.6 per cent in June, having exceeded the BOJ’s target for wisely over two years, and workers’ indecent pay rose by the most in three a protracted time in Might perchance presumably presumably merely, sufficient to for hawks to argue that conditions are correct to hike charges now.

On the other hand, most up-to-date extinct consumption and household sentiment own helped coverage doves fabricate the case for holding off for now and ready for additional files to discover whether or now not tax cuts and rising wages will take dangle of consumption as projected.

The discontinuance result of next week’s assembly is unsure in half for the reason that BOJ sees no compelling cause to scramble, with value rises peaceful average and inflation expectations true advance 2 per cent, the sources said.

“What’s sure is that the BOJ will potentially elevate charges in coming months. It is staunch a ask of of timing,” no doubt one of them said.

BOJ Governor Kazuo Ueda has said the central bank will hike charges if it’s a ways convinced that true economic and wage development will sustain inflation round its 2 per cent in coming years, as projected.

Whereas person costs had been rising in Japan since the COVID-19 pandemic, warding off extended spells of declining costs the economy has again and again skilled proper by the final three a protracted time remains a enlighten for Japanese policymakers.

Having staunch ended unfavorable charges in March, the BOJ peaceful keeps quick-term charges round zero. The following price hike is anticipated to kick off a tightening cycle that can take charges to phases that neither wintry nor stimulate development – seen by analysts as someplace round 0.5 per cent to 1.5 per cent – a process that can also take quite rather a lot of years.

“For the BOJ, there’s peaceful a protracted advance to circulate. One other price hike will peaceful sustain Japan’s financial situation very free,” a second supply said, a gape echoed by two extra sources.

At this month’s assembly, the BOJ will also launch particulars of a quantitative tightening concept on how this can also taper its mountainous bond buying in the arriving one to 2 years, and shrink its nearly $5 trillion stability sheet.

The BOJ is at risk of taper its bond purchases progressively in quite rather a lot of phases at a tempo roughly in step with dominant market views, to sustain a ways from causing an unwelcome spike in yields, the sources said.

That heightens the probability the BOJ would roughly halve month-to-month bond purchases in 1-1/2 to 2 years’ time – a tempo advocated by a sizeable resolution of contributors in a gathering final week between the bank and financial institutions.

The BOJ ended eight years of unfavorable charges and bond yield management in March, in a landmark shift a ways from its radical stimulus programme.

(This fable has been refiled to get rid of the extraneous line in paragraph 14)

Source: Reuters